The Central Bank of Nigeria (CBN) has started selling dollars to Bureau De Change (BDC) operators again after a three-year hiatus.

The move aims to stabilize the naira and narrow the official versus unofficial exchange rate gap.

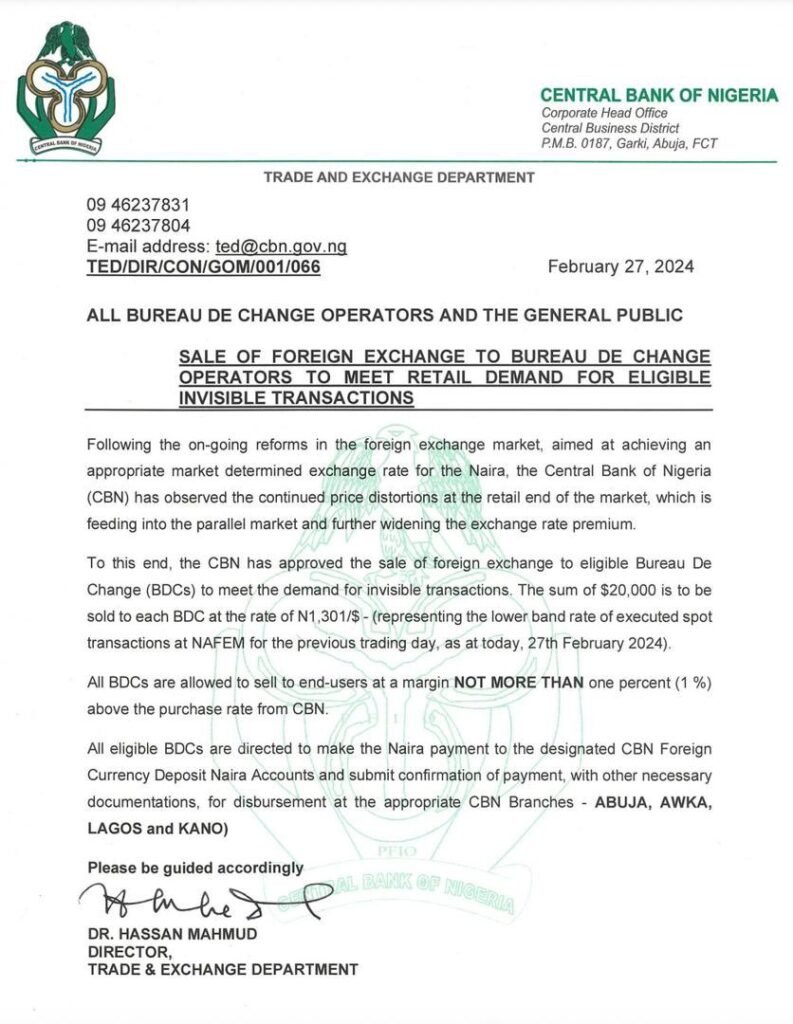

According to a CBN circular, signed by the director, trade and exchange department, Hassan Mahmud, continuous distortions in retail forex rates have widened premiums. Hence, the CBN will now provide $20,000 weekly to each BDC at N1,301 per dollar.

BDCs can then sell to customers at 1% above their purchase rate.

On Tuesday, the naira strengthened to N1,590 per dollar on parallel markets after the CBN announcement.

The naira also climbed 5.22% against the dollar on Monday at the Nigerian Autonomous Foreign Exchange Market (NAFEM).

The directive to sell dollars to customers at 1% above their purchase rates differs from CBN’s posture earlier this month which permitted transactions on a ‘willing buyer, willing seller basis.’

The CBN in frantic efforts to save the free fall of the naira has made a number of reforms towards addressing Naira depreciation, such as probing and clearing FX backlog, limiting forex for foreign education and medical tourism, increasing BDCs’ minimum share capital, and curbing FX speculators, among others